In today’s fast-paced business environment, efficiency is key to success. One of the most important aspects of any company’s operations is payroll management. Whether you have a small team or a large workforce, managing payroll manually can be time-consuming and prone to errors. A modern payroll system can not only save you time but also ensure that your employees are paid accurately and on time. In this article, we’ll explore how modern payroll systems can streamline your business operations and help your company stay compliant, reduce errors, and improve overall efficiency.

1. What is a Modern Payroll System?

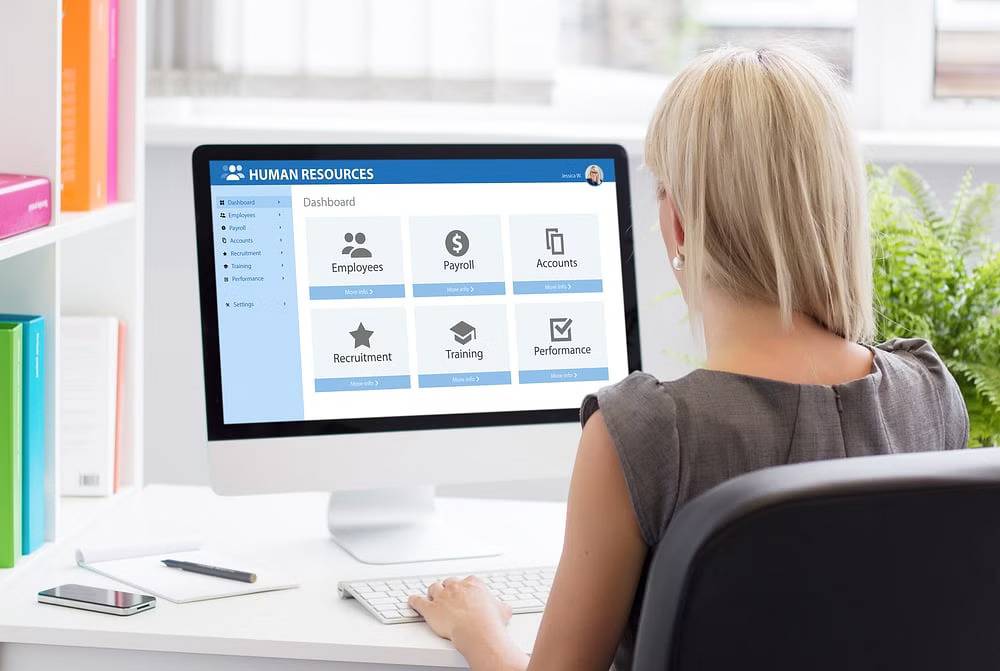

A modern payroll system is a software solution that automates the process of paying employees. It takes care of calculating wages, deducting taxes, generating payslips, and ensuring compliance with local laws and regulations. Unlike traditional manual systems, which require significant input from HR personnel, modern payroll systems are designed to simplify and speed up the entire payroll process.

2. Benefits of Implementing a Modern Payroll System

Improved Accuracy

Manual payroll processing often involves calculations that are susceptible to human error, such as miscalculating tax withholdings or missing important deductions. Modern payroll systems use automated algorithms to perform these calculations, ensuring a high level of accuracy. This not only reduces the risk of errors but also helps maintain compliance with tax laws and regulations.

Time Savings

Managing payroll manually can take hours each pay period, especially for businesses with a large number of employees. With a modern payroll system, much of the work is automated, saving your HR team valuable time. Tasks such as calculating wages, processing benefits, and generating reports can be done with just a few clicks, allowing your team to focus on more strategic tasks.

Enhanced Compliance

Keeping up with ever-changing tax laws, wage regulations, and reporting requirements can be a daunting task. A modern payroll system ensures that your business stays compliant by automatically updating tax tables and regulatory requirements. This helps avoid costly fines or penalties for non-compliance and reduces the burden on your HR team to stay updated with complex regulations.

Better Employee Experience

Employees expect to be paid accurately and on time. A modern payroll system ensures that employees receive their paychecks on schedule, and they can access their pay information online through self-service portals. This transparency not only improves employee satisfaction but also reduces the number of payroll-related queries to your HR department.

3. Key Features of a Modern Payroll System

Cloud-Based Access

Cloud-based payroll systems allow HR teams and managers to access payroll data from anywhere, at any time. This flexibility is particularly useful for businesses with multiple locations or remote employees. It also ensures that your payroll information is securely stored and backed up, reducing the risk of data loss.

Direct Deposit Payments

A modern payroll system allows businesses to set up direct deposit payments for employees, eliminating the need for paper checks. Employees receive their pay directly into their bank accounts, saving time and improving convenience for both the employer and the employee.

Tax Calculation and Reporting

Tax compliance is one of the most critical aspects of payroll management. A modern payroll system automatically calculates federal, state, and local taxes, ensuring that employees are taxed correctly. The system also generates tax reports, making it easier to file tax returns and meet reporting deadlines.

Employee Self-Service Portal

Many modern payroll systems offer self-service portals where employees can view their pay stubs, track their leave balances, and update their personal information. This reduces the workload for HR departments and empowers employees to manage their own payroll-related queries.

Integration with Other HR Systems

A modern payroll system can be integrated with other HR tools such as time tracking, benefits management, and performance management systems. This creates a seamless flow of information between different departments and reduces the need for duplicate data entry.

4. How a Modern Payroll System Enhances Business Operations

Streamlined Workflow

By automating payroll processes, a modern payroll system eliminates many manual tasks, reducing the potential for mistakes and delays. HR departments can easily manage payroll across multiple departments, offices, or locations, streamlining operations and creating a more efficient workflow.

Data Security

A modern payroll system prioritizes the security of sensitive employee data. Cloud-based systems offer robust encryption and security features, ensuring that payroll data is protected from unauthorized access. This is particularly important as businesses need to safeguard employee information to maintain trust and avoid data breaches.

Reporting and Analytics

Modern payroll systems come with built-in reporting and analytics tools, enabling businesses to track payroll expenses, monitor trends, and analyze compensation data. These insights can help you make informed decisions about budgeting, compensation, and workforce planning.

Scalability

As your business grows, your payroll needs will evolve. A modern payroll system is scalable, meaning it can handle an increasing number of employees and more complex payroll requirements without the need for significant upgrades or changes. This makes it easier to manage payroll as your business expands.

5. How to Choose the Right Payroll System for Your Business

When selecting a payroll system for your business, consider the following factors:

Size of Your Business

Larger businesses with hundreds or thousands of employees will need a more robust payroll system, while small businesses can opt for simpler, more affordable solutions. Ensure that the system you choose is suitable for the size and complexity of your workforce.

User-Friendliness

Choose a payroll system that is easy to use and doesn’t require extensive training. The system should have an intuitive interface that allows your HR team to navigate it quickly and efficiently.

Customer Support

Good customer support is essential when choosing a payroll system. Look for a provider that offers reliable customer service and technical support in case you encounter any issues with the system.

Integration Capabilities

Ensure that the payroll system can integrate seamlessly with your existing HR software, accounting tools, and other business systems. This will save time and ensure that your data is consistent across all platforms.

6. Conclusion

A modern payroll system can significantly streamline your business operations, saving time, reducing errors, and ensuring compliance with tax regulations. By automating payroll processes, businesses can focus on more strategic tasks and improve the overall employee experience. Whether you’re a small business or a large enterprise, investing in a modern payroll system is a smart decision that will pay off in the long run.

FAQs

What is the cost of a modern payroll system?

The cost varies depending on the features and size of your business. Basic systems may start at around $20 per month, while more advanced systems can cost hundreds of dollars per month.

Can a payroll system be integrated with accounting software?

Yes, most modern payroll systems can integrate with popular accounting software, helping to streamline financial reporting and eliminate the need for duplicate data entry.

Is training required for using a payroll system?

While many payroll systems are user-friendly, some training may be required for HR personnel to understand all the features and functionalities of the system.

How secure is employee data in a payroll system?

Modern payroll systems use encryption and other security features to ensure that employee data is protected from unauthorized access and breaches.

Can a payroll system handle complex payroll needs?

Yes, most modern payroll systems can handle complex payroll requirements, including multiple pay schedules, tax calculations, and benefits management.